rejekibet.online Prices

Prices

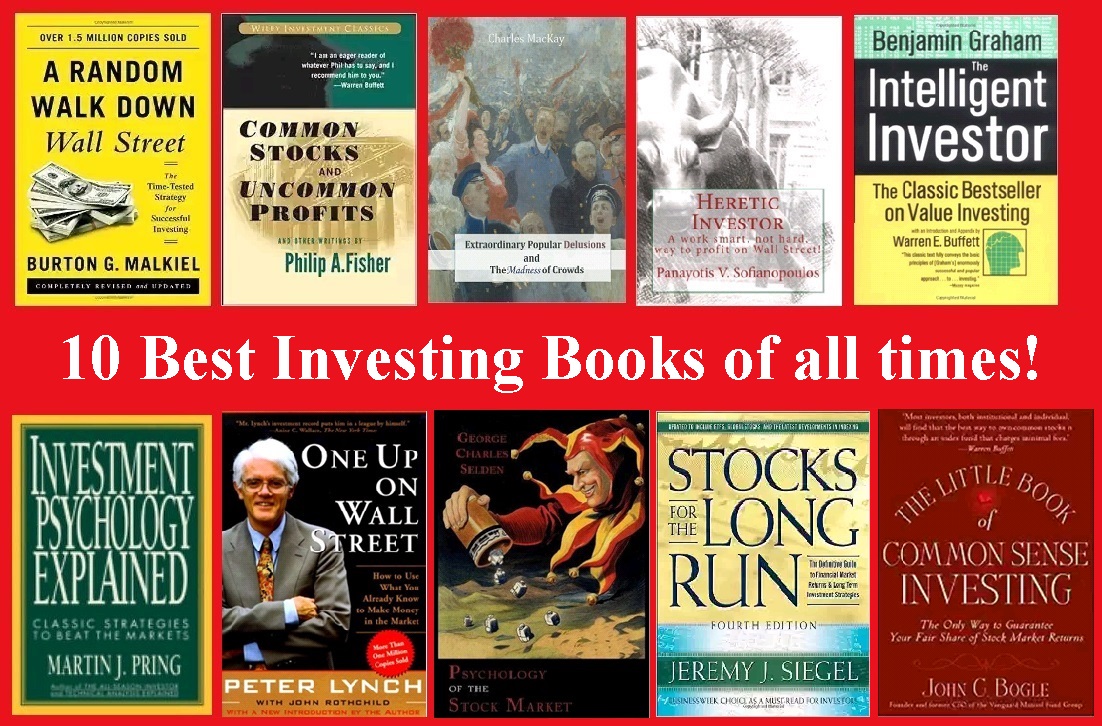

Top Investing Books

We discuss books that can help you understand financial statements, evaluate management, and judge the quality of a business. Top20 Books ; The Smart Money Method · Stephen Clapham ; Capital Returns · Edward Chancellor ; Reminiscences of a Stock Operator · Edwin LeFèvre ; The Most Important. The 7 Best Investing Books · Best Overall: "The Bond King" · Best Book About Value Investing: "The Intelligent Investor" · Best Book on Investments Helping. We have compiled some of the best investing books of all time for growth investors. These include books by O'Neil's biggest trading influences and titles. Here is a list of the best books on investing to help you learn the art of investment and self-control. Read on for our guide on the best books on investing — from beginner advice to commercial real estate and more. These are the five best investing books that you should know about, read and share. It's a mixed bunch, but all of them have great nuggets of advice worth. Here is list of the best investing books about trading, money management, investing and personal finance to help you make money and become financially. Best Investment Books. books — This list was created and voted on by Goodreads members. A collection of best books written on investment. Note: Please do. We discuss books that can help you understand financial statements, evaluate management, and judge the quality of a business. Top20 Books ; The Smart Money Method · Stephen Clapham ; Capital Returns · Edward Chancellor ; Reminiscences of a Stock Operator · Edwin LeFèvre ; The Most Important. The 7 Best Investing Books · Best Overall: "The Bond King" · Best Book About Value Investing: "The Intelligent Investor" · Best Book on Investments Helping. We have compiled some of the best investing books of all time for growth investors. These include books by O'Neil's biggest trading influences and titles. Here is a list of the best books on investing to help you learn the art of investment and self-control. Read on for our guide on the best books on investing — from beginner advice to commercial real estate and more. These are the five best investing books that you should know about, read and share. It's a mixed bunch, but all of them have great nuggets of advice worth. Here is list of the best investing books about trading, money management, investing and personal finance to help you make money and become financially. Best Investment Books. books — This list was created and voted on by Goodreads members. A collection of best books written on investment. Note: Please do.

50 Of The Best Investing Books Of All Time. This list is in no way complete or in any particular order. If you would like a add a book to the list, please add. I sought out the recommended books of 20 of the most successful investors and hedge fund managers of all time. I curated a total of book recommendations. The Boglehead's Guide to Investing is a DIY handbook that espouses the sage investment wisdom of John C. Bogle. This witty and wonderful book offers contrarian. 6 Best Investment Books for · 01 One Up On Wall Street. One Up On Wall Street: How to Use What You Already Know to Make Money in the Market by Peter Lynch. 10 Books to Change How You Invest · “The Intelligent Investor" · "Poor Charlie's Almanack: · "The Little Book of Common Sense Investing" · "A. "The Intelligent Investor" is a comprehensive guide to value investing, written by a renowned financial expert. This book offers timeless wisdom and practical. Top 10 Books Every Investor Should Read by Fisher, Philip A. by Siegel, Jeremy J. by O'Neil, William J. What the Rich Teach Their Kids About Money All the books longlisted for the Financial Times Business Book of the Year Award. Investment & Markets. Winner The Man Who Knew by Sebastian Mallaby. Discover the best personal finance books with practical advice on saving money, budgeting, stock investing, real estate and more. Dig into our list of the Best Investment Books to Build Wealth and Financial Freedom. Real estate investing, tax minimization, options trading & more. 1) The Intelligent Investor This is perhaps the most important and influential book ever written about value investing. I sought out the recommended books of 20 of the most successful investors and hedge fund managers of all time. I curated a total of book recommendations. Read on for our guide on the best books on investing — from beginner advice to commercial real estate and more. 1) The Intelligent Investor This is perhaps the most important and influential book ever written about value investing. Find the best books on real estate investing to kickstart your investing journey and become a master real estate investor. From beginner real estate. Best Books to Read as a Beginner Investor · 1. The Intelligent Investor · 2. One Up On Wall Street · 3. Rich Dad Poor Dad · 4. Stocks for the Long Run · 5. The. Best Books to Read as a Beginner Investor · 1. The Intelligent Investor · 2. One Up On Wall Street · 3. Rich Dad Poor Dad · 4. Stocks for the Long Run · 5. The. We have compiled a list of the best books on investing. These should be the cornerstone of your knowledge, along with the best websites for investors. Rich Dad Poor Dad is a self-help book written by Robert Kiyosaki that advocates for the importance of financial literacy and teaches readers how to build. Jason Zweig, Knowledge Project Guest and author of Your Money and Your Brain, chimes in with the books he recommends for investors.

100 000 Home Equity Loan

For example, if your home is valued at $, and you still owe $, on your mortgage, your home equity value would be $, ($, - $,). Estimate your monthly payments for a home equity loan at First Merchants Bank. Plan your budget and make informed borrowing decisions. Use our home equity loan and home equity line of credit (HELOC) calculator to see which lending options may be available to you. You could borrow $, if, for example, your home is worth $, and you have $, left on your mortgage (because $, × = $, -. Outstanding home loans. Combined Loan to value ratio (CLTV). You may qualify for a $, home equity line of credit. Schedule Call. HELOC and loan amounts. $, Outstanding home loans. Loan to value ratio (LTV). You may qualify for a $, home equity line of credit. Apply Now Learn More. HELOC and loan. Monthly Payment Calculator for Home Equity Loan · Loan Amount: $ · Interest rate: % · Term (months): · * indicates required field. Use our home equity loan calculator to find a rate and monthly payment that fits your budget. Input how much you want to borrow, your estimated home value, your. Your initial payment will be $ for a home equity loan and $33 for a HELOC ; Loan amount. Must be between $1 and $2,, ; Interest rate · Must be between. For example, if your home is valued at $, and you still owe $, on your mortgage, your home equity value would be $, ($, - $,). Estimate your monthly payments for a home equity loan at First Merchants Bank. Plan your budget and make informed borrowing decisions. Use our home equity loan and home equity line of credit (HELOC) calculator to see which lending options may be available to you. You could borrow $, if, for example, your home is worth $, and you have $, left on your mortgage (because $, × = $, -. Outstanding home loans. Combined Loan to value ratio (CLTV). You may qualify for a $, home equity line of credit. Schedule Call. HELOC and loan amounts. $, Outstanding home loans. Loan to value ratio (LTV). You may qualify for a $, home equity line of credit. Apply Now Learn More. HELOC and loan. Monthly Payment Calculator for Home Equity Loan · Loan Amount: $ · Interest rate: % · Term (months): · * indicates required field. Use our home equity loan calculator to find a rate and monthly payment that fits your budget. Input how much you want to borrow, your estimated home value, your. Your initial payment will be $ for a home equity loan and $33 for a HELOC ; Loan amount. Must be between $1 and $2,, ; Interest rate · Must be between.

If a lender permits home equity loans up to 85% of the home's value, the calculation would look like this: $, (home's value) x = $, - $, Loans around k are - %~6% - with 20 to 30 year terms. Monthly payments around $ ~ $ Here's our Income: My Income: k. Yearly. Home equity: Most lenders want you to have at least 20% equity in your home. Credit score: HELOC lenders usually require a minimum FICO score of , and many. Find out how much your monthly payment could be for your home equity loan, based on your loan amount and interest rate. Use our home equity line of credit (HELOC) payoff calculator to figure out your monthly payments on your home equity line based on different variables. Today's Home Equity Lenders generally won't allow you to borrow % of the value of your home. In certain market conditions, you may be able to borrow up to. Home equity assumptions (discount information plus disclosures and additional assumptions) based on a $, line of credit Back to content. Fixed-Rate Loan. What is the monthly payment on a $ home equity loan? The monthly payment for a $ home equity loan around $ a month assuming the interest. loans of a 5, 10, 15, 20 or 30 year duration. Compare Home Equity Rates for Aug. 25, Advertiser Disclosure. $, Loan in California. $, Home. See how much you might be able to borrow from your home. Just enter some basic information in our home equity loan calculator to find out. ON THIS PAGE. loans of a 5, 10, 15, 20 or 30 year duration. Compare Home Equity Rates for Aug. 25, Advertiser Disclosure. $, Loan in California. $, Home. See how additional payments could impact your overall loan balance with Dutch Point Credit Union's Home Equity Line of Credit Interest Calculator % of the. loan amount Existing loans Your credit limit 0 50K K K K K. End of Let Us Help With Your Home Equity Loan. Apply. Or call our home equity. Example home equity loan for a home with a k valuation Let's say that your home is worth $, and that your current mortgage balance is $50, This. home's value, and you'll come up with $, in home equity. How HELOC (Home Equity Line of Credit) and Home Equity Loan: Comparing Your Options. The maximum amount you're allowed to borrow, also known as your loan amount, is determined by the equity in your home. Typically lenders will extend a line of. Your home equity gives you financial flexibility. Find out how much you may qualify to borrow through a mortgage or line of credit. What is the monthly payment on a $ home equity loan? - The payment for a $ home equity loan is $ a month with a 15 year term and %. A home equity loan is often referred to as “a second mortgage” and is taken out in one lump sum. A HELOC is a line of credit you can draw funds from as needed.

Scalp Trader

Intelligent, Focused and Determined. SCALP Trade is a proprietary trading firm that was founded in Over time, SCALP Trade has expanded its core business. If you have low leverage available, you may need more capital to scalp and get decent profits from a single trade. How Does Swing Trading Work? A medium-term. Scalp trading, or stock scalping, is a hyper-short-term trading strategy that requires investors to buy and sell securities quickly. Crypto Scalp Trading: Learn the Basics. Scalp trading, also known as scalping, is a crypto trading strategy to make repeated profits over a short period of time. Can you scalp trade? Updated over a week ago. We allow our traders to. The Trade Scalper® is one of the most powerful price action trading methods/software available only at rejekibet.online We explain how to Scalp Trade any. Scalping is a day trading style that many professional traders use. It is one of the shortest trading cycles among other forms of trading. Work With Us SCALP Trade is a group of driven and dynamic individuals focused on deep problem solving, with the desire to be a positive force in the capital. Scalping (trading) · a legitimate method of arbitrage of small price gaps created by the bid–ask spread, or · a fraudulent form of market manipulation. Intelligent, Focused and Determined. SCALP Trade is a proprietary trading firm that was founded in Over time, SCALP Trade has expanded its core business. If you have low leverage available, you may need more capital to scalp and get decent profits from a single trade. How Does Swing Trading Work? A medium-term. Scalp trading, or stock scalping, is a hyper-short-term trading strategy that requires investors to buy and sell securities quickly. Crypto Scalp Trading: Learn the Basics. Scalp trading, also known as scalping, is a crypto trading strategy to make repeated profits over a short period of time. Can you scalp trade? Updated over a week ago. We allow our traders to. The Trade Scalper® is one of the most powerful price action trading methods/software available only at rejekibet.online We explain how to Scalp Trade any. Scalping is a day trading style that many professional traders use. It is one of the shortest trading cycles among other forms of trading. Work With Us SCALP Trade is a group of driven and dynamic individuals focused on deep problem solving, with the desire to be a positive force in the capital. Scalping (trading) · a legitimate method of arbitrage of small price gaps created by the bid–ask spread, or · a fraudulent form of market manipulation.

Scalping is a day trading technique where an investor buys and sells an individual stock multiple times throughout the same day. · The goal of a scalper is not. Scalpers, i.e. traders who do scalp trading, trade frequently, in a matter of minutes and seconds. A scalp trader needs to have a strict exit policy because one. Scalp trading, often referred to as scalping, is a strategy where traders aim to profit from small price changes in the stock market. This approach involves. Forex scalping is a short-term trading strategy that attempts to make a profit out of small price movements within the forex market. SCALP Trade is a proprietary trading firm that was founded in Over time, SCALP Trade has expanded its core business of options trading to include. This article explores the intricacies of scalp trading, including its strategies, tools, benefits, risks, and tips for success. One or two rupees per scalp be insignificant profits for the trades who do scalp trading, and to avoid this, they buy a large number of shares. For instance, a. Scalping Trading Strategy to beat the markets! Easy forex trading course for Scalpers. Learn Forex scalping day rejekibet.online: out of reviews4 total. This sort of trading basically involves you purchasing and selling many times during a day, gaining your profits through the differences in prices. Purchasing. Scalping is a trading style in which the trader elects to take small profits quickly as they become available within the marketplace. Scalping or scalp trading is a short term trading strategy that aims to profit from small price movements. Learn how it works. Scalping is a trading strategy that aims to profit from very small price movements by making rapid buy and sell decisions, often within. As long as you have demonstrable execution logic and can vouch for the trades you take and how and why they worked if they ask, you won't have. Scalping is a shortest-term trading strategy that focuses on making small gains from minor price movements. Understand their advantage and disadvantage. Scalping is a trading strategy that requires the trader to place multiple trades, which seek to close out small profits over extremely short time frames. For. I prefer to sell trades after a pump up as I have observed pullbacks in buy moves are easier to scalp than buys in a sell off scenario. I try to. Scalp trading is a day trading strategy targeting quick, small profits. ○ Traders using this strategy make money by adding up their small profits. Pros and Cons of Scalp Trading · Pros · Scalping can be incredibly profitable and enjoyable for the right people: · Scalpers can profit from price movements. Scalping is a day trading strategy that involves opening and closing trades within a short period of time. Scalp trading is a short-term trading strategy in which traders aim to take advantage of quick moving price action. Learn more.

How Long To Keep Collision Insurance On A Car

Even though collision insurance is optional, drivers should still consider purchasing collision car insurance in order to protect their finances in the event of. Yes, as long as you already have an existing automobile insurance policy and collision or other than collision (Comprehensive) coverage? You can. You must register your vehicle at the DMV within days of the effective date on your Insurance ID Card. Bring one copy or form of your Insurance. In some cases, a minor accident could "total" your car and having collision/comprehensive might not be worth it. . . This guide is NOT a complete summary of. If you purchased Collision or Upset Coverage, your insurance company will auto accidents when no auto insurance policy exists to cover the claim. Collision insurance – or collision coverage – helps cover the cost of damage to your vehicle if you are in an accident with another vehicle or object. On the flip side, if it's seven years old and only worth $3,, keeping collision may not make sense. Run the Numbers. If you keep your car long enough, there. When Should I Drop Comprehensive and Collision Insurance? · 1. When the Cost of Car Insurance Nearly Meets or Exceeds Your Car's Value · 2. You're Willing and. Your collision premiums and your deductible are more than 10 percent of your vehicle's blue book value. Another rule of thumb is to consider the Actual Cash. Even though collision insurance is optional, drivers should still consider purchasing collision car insurance in order to protect their finances in the event of. Yes, as long as you already have an existing automobile insurance policy and collision or other than collision (Comprehensive) coverage? You can. You must register your vehicle at the DMV within days of the effective date on your Insurance ID Card. Bring one copy or form of your Insurance. In some cases, a minor accident could "total" your car and having collision/comprehensive might not be worth it. . . This guide is NOT a complete summary of. If you purchased Collision or Upset Coverage, your insurance company will auto accidents when no auto insurance policy exists to cover the claim. Collision insurance – or collision coverage – helps cover the cost of damage to your vehicle if you are in an accident with another vehicle or object. On the flip side, if it's seven years old and only worth $3,, keeping collision may not make sense. Run the Numbers. If you keep your car long enough, there. When Should I Drop Comprehensive and Collision Insurance? · 1. When the Cost of Car Insurance Nearly Meets or Exceeds Your Car's Value · 2. You're Willing and. Your collision premiums and your deductible are more than 10 percent of your vehicle's blue book value. Another rule of thumb is to consider the Actual Cash.

If you cannot afford a new car if your vehicle needs to be replaced, you should keep your collision coverage until you can start saving up for a new one. · If. Collision coverage pays for damage to your auto that is caused by the physical contact of your auto with another object, such as another vehicle or property. For instance, if the cost of your collision coverage is 10% or more of the value of your car, then you should probably drop collision coverage. If you lease or. Prevent · Travelers Garage · Car Insurance Tips & Resources; Does Car car, but comprehensive insurance coverage and collision insurance coverage may not. For everyone else, the general rule of thumb is: if your car is older than ten years, consider removing your collision coverage. But remember to decide for. No state requires collision and comprehensive coverage, but these are valuable insurance types that shouldn't be overlooked. And if you have a car loan or lease. A year-old car isn't required by law to be insured any more than a brand new one is. Like any car though, older cars may still need collision insurance if. When comparing auto insurance companies, here are some things to consider: How long has the insurance company been in business? Look for an insurance provider. If your car is paid off and you plan on driving it for a long time, if your vehicle is worth a good chunk of change, or you simply want peace of mind that you. Collision insurance is a coverage that helps pay to repair or replace your car if it's damaged in an accident with another vehicle or object. vehicle insurance coverage on a continuous basis as long as you own a car. Failure to maintain liability insurance coverage for your car at all times. When there is no lien on the vehicle, and when it's worth is such that you can absorb the loss, then consider dropping collision, or at least. Collision coverage helps them protect their investment if your car is damaged in an accident. The benefits aren't limited to lenders, though. If you don't have. You should not drop collision coverage, however, if you are short on money. If you cannot comfortably afford to pay to replace your vehicle on your own, you. Collision insurance covers expenses for repairs or replacements to your car if damaged in an accident — no matter who is at fault. collision, your car's repairs would be covered by comprehensive car insurance coverage. insurance coverage, keep in mind that the deductible is your. Repairs must be finalized within two years from the date of the collision. It's a good idea to complete repairs as soon as possible to avoid any deterioration. Older vehicles aren't necessarily less expensive to insure. But it may not make sense to keep collision or comprehensive coverage on lower value cars because. Yes, as long as you already have an existing automobile insurance policy and collision or other than collision (Comprehensive) coverage? You can.

Business Credit Card No Personal Ssn

No matter the size or scope of your business, you may be eligible for a business credit card. If you don't have an EIN, you can use your Social Security number. The SVB Innovator Card has been named one of the “best business credit cards with no personal guarantee” by card reviewer The Points Guy virtual cards img. Applying for a business credit is similar to applying for a personal credit card. Ideally, you would apply for the card without using your SSN and avoid making. Credit Card, you'll also have access to Visa's special security benefits. Can't I just use my personal credit card instead of a small business credit card? With no annual fee and a lower interest rate, the Truist Business Credit Card wants to make sure every penny counts for your small business. Apply now. Fraud and Security. What do I do if I suspect there has been an unauthorized transaction on my business credit card? business credit card application. When a personal guarantee is required, you must provide a Social Security Number and they will check your. Join thousands of top business leaders today. No personal guarantee or personal credit check required. Checking and card services provided by Webster Bank. You can get Business Credit on your EIN alone and not your SSN which means that you can get the cash flow you need to operate and scale without. No matter the size or scope of your business, you may be eligible for a business credit card. If you don't have an EIN, you can use your Social Security number. The SVB Innovator Card has been named one of the “best business credit cards with no personal guarantee” by card reviewer The Points Guy virtual cards img. Applying for a business credit is similar to applying for a personal credit card. Ideally, you would apply for the card without using your SSN and avoid making. Credit Card, you'll also have access to Visa's special security benefits. Can't I just use my personal credit card instead of a small business credit card? With no annual fee and a lower interest rate, the Truist Business Credit Card wants to make sure every penny counts for your small business. Apply now. Fraud and Security. What do I do if I suspect there has been an unauthorized transaction on my business credit card? business credit card application. When a personal guarantee is required, you must provide a Social Security Number and they will check your. Join thousands of top business leaders today. No personal guarantee or personal credit check required. Checking and card services provided by Webster Bank. You can get Business Credit on your EIN alone and not your SSN which means that you can get the cash flow you need to operate and scale without.

For sole proprietors, this is most likely your Social Security number, unless you have an EIN. Legal structure of the business. If you have an LLC, is it a. For sole proprietors, this is most likely your Social Security number, unless you have an EIN. Legal structure of the business. If you have an LLC, is it a. Your EIN is simply your Social Security number. The name of your business can be your own name. The number of employees can be “1.” If you operate another type. What do I need to have when I apply for a small business credit card? · Business Tax ID (or Social Security number for sole proprietors) · Legal business name and. The best business credit card you can get without a Social Security number is the Capital One Spark 2% Cash Plus * Card because you can apply with an Individual. An EIN acts like your business's Social Security number, ensuring your personal and business finances are separate. MoneyGeek explains how to leverage your. EIN Only Business Credit Cards That Don't Report to the Personal Credit Bureaus · 1. American Express Cards · 2. Bank of America Cards · 3. Chase Cards · 4. Citi. What you need to fill out a business credit card application · Personal information: name, address, Social Security number (SSN), phone number, email, annual. When applying for a business credit card, the issuer will require either your SSN, your EIN or both. I've never heard of any company requiring. Most business credit cards require applicants to share their Social Security number (SSN) and provide a personal guarantee. Exceptions include some corporate. There's really no answer to your question. A bank is not going to give you a credit line for a brand new business without a personal guarantee. It can be difficult to take part in the U.S. financial system without a Social Security number. Many financial institutions require an SSN on an application. Small Business credit cards are backed by personal credit, however they are not included on your credit report as long as your credit card is in good standing. Your full name, residential address, date of birth, Social Security Number, and contact info A business credit card works the same way as your personal credit. Best for travel rewards: American Express® Gold Card ; Best for cash back · Capital One QuicksilverOne Cash Rewards Credit Card ; Best for no annual fee · Chase. Lots of other providers offer business cards that don't require a social security number. Each card offers different ways to earn points, cash in rewards, and. Fortunately, although corporate cards have stricter application requirements, it's entirely possible to receive a business credit card without having to list. Certain lenders prioritize Social Security Number (SSN)-based applications for assessing an individual's personal credit record, which is not applicable for EIN. No annual fee. Personal cards. New offer New offer. U.S. Bank Business Altitude Yes, when you apply for a U.S. Bank business credit card you can request.

W2 For Home Loan

A no-income-verification mortgage is a home loan that doesn't require the documentation that standard loans typically require like pay stubs, W2s or tax returns. Fidelity Home Group offers a 1-Year Tax Return Loan Program for Self-Employed / Business Owners as well as those whose employment histories and tax returns may. To apply for a home loan without a W2 you will need to provide copies of your tax returns and research the types of home loans available nationwide. W-2 jobs. Your income stream is different, and your tax situation is different. When it comes time to go through the mortgage process and buy a home, you. It can be difficult for high net worth people to qualify for a traditional mortgage. The problem? No tax forms confirming a steady paycheck. Your income is a big piece of the puzzle when it comes to qualifying for a mortgage. The lender is required to calculate a monthly gross income figure using. Thanks to the innovative W2-only income mortgages, no tax returns are necessary, enabling W2 wage earners to qualify for home loans. It's important to note that. An FHA W-2 Income Only mortgage is tailored for borrowers whose primary source of income comes from traditional employment. This program places significant. Thanks to the innovative W2-only income mortgages, no tax returns are necessary, enabling W2 wage earners to qualify for home loans. It's important to note that. A no-income-verification mortgage is a home loan that doesn't require the documentation that standard loans typically require like pay stubs, W2s or tax returns. Fidelity Home Group offers a 1-Year Tax Return Loan Program for Self-Employed / Business Owners as well as those whose employment histories and tax returns may. To apply for a home loan without a W2 you will need to provide copies of your tax returns and research the types of home loans available nationwide. W-2 jobs. Your income stream is different, and your tax situation is different. When it comes time to go through the mortgage process and buy a home, you. It can be difficult for high net worth people to qualify for a traditional mortgage. The problem? No tax forms confirming a steady paycheck. Your income is a big piece of the puzzle when it comes to qualifying for a mortgage. The lender is required to calculate a monthly gross income figure using. Thanks to the innovative W2-only income mortgages, no tax returns are necessary, enabling W2 wage earners to qualify for home loans. It's important to note that. An FHA W-2 Income Only mortgage is tailored for borrowers whose primary source of income comes from traditional employment. This program places significant. Thanks to the innovative W2-only income mortgages, no tax returns are necessary, enabling W2 wage earners to qualify for home loans. It's important to note that.

Every lender has different loan application requirements. Among these requirements are current tax returns and income proof for a given period. The income only mortgage loan program is a non-QM loan option where 90% of the income is used as the qualified income for a mortgage. W-2 forms. Your mortgage lender will likely ask for W-2s from the last one to two years for each applicant. If you don't have them, check. W-2 income tax statements for the last two years: You should be able to find copies attached to your tax returns. If you filed taxes electronically, you or. Most lenders will require years of both personal and business (if applicable) tax returns when assessing your income level. This is because a mortgage loan. Lenders will require documentation of your income, such as W-2 forms and pay stubs, to verify that you have a steady income. They'll also want to see that your. A copy of your W-2 forms for the past two years and a copy of your completed and signed personal tax returns (IRS Form ) for the past two years. Lenders use your tax returns to verify your income. They also look at your W2s or other income statements. Not having verifiable tax returns is a red flag. Atlantic Home Capital specializes in providing mortgages to people who do not have a W2 to show their proof of income. However, the W2 form will not show all sources of income that you may receive. For example, rental property income, dividend income and even alimony or child. W2's or Tax Returns are NOT required on all loans. Some loans are solely based on the asset itself as well as the borrowers credit. For W-2 employees, income verification is straightforward: they provide W-2 forms and pay stubs. S-Corp owners, however, must supply additional documentation. Independent contractors have always been disadvantaged in qualifying for a mortgage. While maximum ratios of housing expense to income are the same for the two. For W2 income mortgages, the documents you will need are mortgage documents required but not federal income tax returns. The W2s are the essential documents for. Most lenders will require two years of W-2's as well as Federal Income Tax returns. Salary is a major component of credit-worthiness but not. A loan is a good mortgage loan option for those that are self-employed, freelancers, contractors, recently switched from W2 to ; anyone who files taxes. We can combine W-2, , and Bank Statements to calculate your monthly income. When looking at your business or personal bank statements, we will review either. Most traditional banks require full documentation of income, including tax returns, W2s and paychecks. However, self-employed individuals typically don't. Unlike a traditional home buyer, self-employed home buyers can't simply produce a W2 to prove their income. Instead, self-employed applicants are expected.

What Mortgage Can I Afford First Time Buyer

Use Zillow's affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and. How much mortgage can I afford? The first step in searching for your home is understanding how large of a mortgage you can afford. With a few inputs, you can. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. How much you can afford to spend on a home depends on several factors, including these primary factors: you and your co-borrower's annual income, down payment. The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit. Most first-time homebuyers can qualify for a first-time homebuyer loan with a credit score and a $1, down payment. Lenders will also look at your debt-to. In my case, $4,/month was my MAX but $4,/month was most realistic. From there, I only used the mortgage calculators on-line to figure out. TDS looks at the gross annual income needed for all debt payments like your house, credit cards, personal loans and car loan. Depending on the lender, TDS. How Much Can You Afford? · You can afford a home worth up to $, with a total monthly payment of $1, · Related Resources. Use Zillow's affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and. How much mortgage can I afford? The first step in searching for your home is understanding how large of a mortgage you can afford. With a few inputs, you can. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. How much you can afford to spend on a home depends on several factors, including these primary factors: you and your co-borrower's annual income, down payment. The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit. Most first-time homebuyers can qualify for a first-time homebuyer loan with a credit score and a $1, down payment. Lenders will also look at your debt-to. In my case, $4,/month was my MAX but $4,/month was most realistic. From there, I only used the mortgage calculators on-line to figure out. TDS looks at the gross annual income needed for all debt payments like your house, credit cards, personal loans and car loan. Depending on the lender, TDS. How Much Can You Afford? · You can afford a home worth up to $, with a total monthly payment of $1, · Related Resources.

In order to determine how much mortgage you can afford to pay each month, start by looking at how much you earn each year before taxes. Consider all your. To get a rough estimate of what you can afford, most lenders suggest you spend no more than 28% of your monthly income — before taxes are taken out — on your. The maximum DTI you can have in order to qualify for most mortgage loans is often between %, with your anticipated housing costs included. To calculate. Your purchase price: $, · Down payment: $36, (6% of the total purchase price, about the average for first-time buyers) · Loan term: year fixed · Loan. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. There are many factors that go into determining how much home you can comfortably afford — including your income, debt and desired down payment. Our. How Much House can I Afford? If you make a down payment below 20% of the home price, you may be required to purchase Private Mortgage Insurance (PMI). What's. For the purposes of this tool, the default insurance premium figure is based on a premium rate of % of the mortgage amount, which is the rate applicable to a. If you're thinking of buying a house, you can use this simple home affordability calculator to determine how much you can afford based on your current. How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. Gross. A 20% DTI is easier to pay off during stressful financial periods compared to, say, a 45% DTI. Home-buyers who are unsure of which option to use can try the. The First-Time Home Buyer Incentive · Owning a homeOpen. Manage your Find an estimate of how much mortgage or rent you can afford. Debt service. However, a 50% debt-to-income ratio isn't going to get you that dream home. Most lenders recommend that your DTI not exceed 43% of your gross income.2 To. Use our affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and. Deciding how much house you can afford If you're not sure how much of your income should go toward housing, start with the 28/36 rule, which dictates you. To stay within an hour of my job the lowest priced liveable houses are around $k. Most mortgage calculators work out to a $$ monthly. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. Lenders divide your total monthly debt payments by your income to determine whether or not you can afford another loan. The higher your down payment, the. The period of time it will take to pay off the principal amount of a mortgage. Find out how much home you can afford. Maybe you already know you want: 1. FHA home loans were created to help first-time homebuyers purchase a home. FHA calculators let homebuyers and homeowners understand what they can afford to.

Best Automated Email Marketing Software

Our Marketing Cloud integrates with sales and service, allowing you to build a complete picture of your customers and deliver automated emails that are relevant. Mailjet. Mailjet is the email solution for teams to create, send, and monitor marketing emails, transactional emails via its intuitive multi-user, drag-. Some commonly used tools include Show by Animaker, Mailchimp, Constant Contact, and HubSpot. Each of these platforms offers a range of features. Active Campaign's ecommerce dashboard helps them to create personalized and highly targeted email campaigns quickly from the platform's selection of Our Top Tested Picks · HubSpot Marketing Hub · Campaigner · Mailchimp · Brevo · GetResponse · Klaviyo · Zoho Campaigns · Omnisend. Mailchimp also makes it easy for beginners with its AL-powered Email Content Generator. The tool enables customers to create marketing email campaigns with the. GetResponse is an email marketing software that is used for designing email marketing, building websites, and creating landing pages. Reviewers like the user-. Adobe Marketo Engage Adobe Marketo Engage is perhaps the best-known marketing automation tool, and for good reason. It's one of the most mature tools, with a. 6) Mailchimp. Mailchimp, as an email automation tool, offers a versatile range of features. With the Customer Journey Builder, you can efficiently automate. Our Marketing Cloud integrates with sales and service, allowing you to build a complete picture of your customers and deliver automated emails that are relevant. Mailjet. Mailjet is the email solution for teams to create, send, and monitor marketing emails, transactional emails via its intuitive multi-user, drag-. Some commonly used tools include Show by Animaker, Mailchimp, Constant Contact, and HubSpot. Each of these platforms offers a range of features. Active Campaign's ecommerce dashboard helps them to create personalized and highly targeted email campaigns quickly from the platform's selection of Our Top Tested Picks · HubSpot Marketing Hub · Campaigner · Mailchimp · Brevo · GetResponse · Klaviyo · Zoho Campaigns · Omnisend. Mailchimp also makes it easy for beginners with its AL-powered Email Content Generator. The tool enables customers to create marketing email campaigns with the. GetResponse is an email marketing software that is used for designing email marketing, building websites, and creating landing pages. Reviewers like the user-. Adobe Marketo Engage Adobe Marketo Engage is perhaps the best-known marketing automation tool, and for good reason. It's one of the most mature tools, with a. 6) Mailchimp. Mailchimp, as an email automation tool, offers a versatile range of features. With the Customer Journey Builder, you can efficiently automate.

AWeber. AWeber is a user-friendly email marketing platform with a great email editor and an automated template designer, plus hundreds of premade templates. The post will compare and review some of the best email marketing automation tools. We'll look at each tool's features, how they can help you grow your. One of the most popular email marketing platforms, and for good reason, MailChimp does not disappoint. The digital marketing application comes loaded with an. Email marketing automation is a magic wand for your marketing strategy. With the ability to pre-plan email sends based on audience data and behaviors, email. I recommend using GetResponse or Moosend. Both are good options, but GetResponse is definitely one of the best email marketing services available. Constant Contact is an email marketing tool that allows users to create email campaigns, add contacts, and automate emails based on customer actions. Users like. OptinMonster is the best email marketing automation tool that lets you collect and automatically segment email addresses based on the user's. Popular marketing automation tools option to consider include Salesmate, Marketo, Pardot, and ActiveCampaign. Consider your needs and budget when selecting. Salesmate is much more than an email marketing software. It's a complete CRM and Unified Customer Platform. See Salesmate can do for your entire business. Boost email opens with AI-generated subject lines and email copy · Design stunning emails with customizable templates for newsletters, events, and more · Automate. Email marketing automation is the process of using software to automate repetitive tasks in your email campaigns. This allows you to send messages to your. Mailchimp is among the most popular email marketing tools for individuals and small businesses. While the company was acquired by Intuit, Mailchimp still exists. Aweber is another free autoresponder you can use to create an automated sequence of emails for your target audience. We found this email marketing platform. But one of my favorite things about ActiveCampaign is its automation tools. You can send broadcast, triggered and targeted emails, autoresponders, funnel emails. Best email marketing platforms for startups · 1. Ortto · 2. Mailchimp · 3. Campaign Monitor · 4. Moosend · 5. Omnisend · 6. Privy · 7. AWeber · 8. GetResponse. Email automation software integrates with website platforms such as WordPress using API integrations through plugins or third-party apps. And if you run an. ActiveCampaign is an affordable email marketing platform, making it great for small marketing teams and creators. It includes all the features you'd expect like. Discover the 21 best email marketing automation software you can use in Select the suitable tool for your needs and improve email marketing efforts. Mailchimp is the email marketing and marketing automation platform. Most email marketing platforms tell you how your campaigns perform, but Mailchimp goes a. HubSpot Email Marketing HubSpot, probably best known for their marketing automation platform, recently launched a free email marketing tool that can support a.

Request Credit Line Increase Credit Score

Submitting a request for a credit limit increase is typically very straightforward. The options include reaching out to your current credit card issuer either. Online: Some credit issuers provide the option to request a credit line increase online. · By phone: Call your issuer's customer service number and explain that. Call your credit card company. The back of your card has a customer service number you can call and learn if you're eligible for an increased limit. You may. In order to be considered for a possible credit limit increase in the future, your income and mortgage or rent information must be fresh. We recommend updating. Increasing your credit limit could improve your credit score in the long run. Schulz notes that you shouldn't be too concerned if your card issuer performs a. Keep in mind that a request could result in a hard credit inquiry, which might slightly impact your overall credit score. The most effective time for requesting. One way to do this is to simply call customer service and see if your income information has been updated. If it's all set, consider asking directly for a. Minimal Credit Score Impact: Requesting and receiving a credit line increase is less detrimental to your credit standing than applying for and opening a new. Increasing your credit limits will help your score, as utilization % is a key determining factor. It will almost certainly be a hard pull. Submitting a request for a credit limit increase is typically very straightforward. The options include reaching out to your current credit card issuer either. Online: Some credit issuers provide the option to request a credit line increase online. · By phone: Call your issuer's customer service number and explain that. Call your credit card company. The back of your card has a customer service number you can call and learn if you're eligible for an increased limit. You may. In order to be considered for a possible credit limit increase in the future, your income and mortgage or rent information must be fresh. We recommend updating. Increasing your credit limit could improve your credit score in the long run. Schulz notes that you shouldn't be too concerned if your card issuer performs a. Keep in mind that a request could result in a hard credit inquiry, which might slightly impact your overall credit score. The most effective time for requesting. One way to do this is to simply call customer service and see if your income information has been updated. If it's all set, consider asking directly for a. Minimal Credit Score Impact: Requesting and receiving a credit line increase is less detrimental to your credit standing than applying for and opening a new. Increasing your credit limits will help your score, as utilization % is a key determining factor. It will almost certainly be a hard pull.

If the company makes a hard credit check, that may lower your score a bit, but usually only temporarily. How Often Can You Request a Credit Limit Increase? In. Finally, spacing out credit line increase requests and opening new accounts sparingly can help keep credit scores on track. Whether you're looking to build. Lower your credit utilization rate · How much will this action impact your credit score? · Option 1. Request a credit limit increase · Option 2. Apply for a new. Accept an increase on your credit limit Improving your debt utilization ratio is one of the fastest ways to build up your credit; you could even see your. To request a credit limit increase, call your card issuer's customer service number (generally on the back of your card) or apply online. You will usually need. Increasing your credit limit could lower your credit utilization ratio. If your spending habits stay the same, you could boost your credit score. When could a request to increase your credit card limit hurt your score? Sometimes a credit line increase request will require a hard credit pull. This means. If they perform a hard pull and then deny your request, your FICO Credit Score will probably take a small hit due to the hard inquiry itself. If you're planning to make a large purchase, such as a house or a car, having a higher credit score will help get you more preferable loan terms. Share This. Managing credit responsibly and opening a new line when you need one will increase your available credit Increase an existing credit line if the creditor. You might also be wondering if requesting a credit-limit increase will affect your credit score. It depends. If your card issuer pulls a hard credit report to. Online: Some credit issuers provide the option to request a credit line increase online. · By phone: Call your issuer's customer service number and explain that. When to ask · Got a pay increase · Paid an existing debt in full · Have a proven track record of paying your bills on-time for at least six months · Continually pay. Will Requesting a Credit Limit Increase Affect Your Credit Score? Depending on the lender and the amount that you request, the credit card issuer may conduct. How will this impact my credit score? The increase will not negatively impact your credit score. In fact, in most cases, an increased limit shows you are credit. Online: Some credit issuers provide the option to request a credit line increase online. · By phone: Call your issuer's customer service number and explain that. You may request an increase in your credit limit by calling the toll-free number on the back of your card. How do I request my credit card PIN? Under “Account”, select the “Credit Limit Increase” option and follow the easy steps to submit your request. Ready to get started? LOG IN to your account. Or. Request an Apple Card credit limit increase · Open the Settings app. · Scroll down and tap Wallet & Apple Pay. · Tap Apple Card, then tap the Info tab. · Tap the. In many cases, line increases requested through this online process or by calling will not require an additional credit bureau check (also known.

Good Health Insurance In India

Key Benefits of Health Insurance Plans in India · Hospitalization Expenses · Pre & Post Hospitalization Expenses · ICU Charges · Ambulance Cost · Cashless Treatments. Best Health Insurance in India for Expats or Foreigners. For all foreign nationals living in India, we recommend the Cigna Global plan as it offers. Best Health Insurance Plans to secure yourself · Star Women Care Insurance Policy · Star Comprehensive Insurance Policy · Senior Citizens Red Carpet Health. Best Health Insurance in India for Expats or Foreigners. For all foreign nationals living in India, we recommend the Cigna Global plan as it offers. Buy/Renew health insurance in india, medical insurance plans with Tata AIG Check your health insurance premium quotes now & get the best health insurance. Protect your health with Niva Bupa, the best health insurance company in India. Our affordable health, medical & travel insurance cover provides. Buy the best health insurance plans online. Secure yourself financially against health-related uncertainties with care's best medical insurance plans. Best health insurance with a low premium changes based on coverage, network, and others. Make a choice of a specific policy which will be affordable. Buy Best health insurance plans for individuals and family to avail Cashless Treatments, Free Health Check Up, critical illness cover, Tax Benefits Upto. Key Benefits of Health Insurance Plans in India · Hospitalization Expenses · Pre & Post Hospitalization Expenses · ICU Charges · Ambulance Cost · Cashless Treatments. Best Health Insurance in India for Expats or Foreigners. For all foreign nationals living in India, we recommend the Cigna Global plan as it offers. Best Health Insurance Plans to secure yourself · Star Women Care Insurance Policy · Star Comprehensive Insurance Policy · Senior Citizens Red Carpet Health. Best Health Insurance in India for Expats or Foreigners. For all foreign nationals living in India, we recommend the Cigna Global plan as it offers. Buy/Renew health insurance in india, medical insurance plans with Tata AIG Check your health insurance premium quotes now & get the best health insurance. Protect your health with Niva Bupa, the best health insurance company in India. Our affordable health, medical & travel insurance cover provides. Buy the best health insurance plans online. Secure yourself financially against health-related uncertainties with care's best medical insurance plans. Best health insurance with a low premium changes based on coverage, network, and others. Make a choice of a specific policy which will be affordable. Buy Best health insurance plans for individuals and family to avail Cashless Treatments, Free Health Check Up, critical illness cover, Tax Benefits Upto.

Bajaj Allianz General Insurance Company's Top-Up Health Insurance plan provides additional coverage beyond the sum insured by the base health insurance policy. Explore the best health insurance plans in India for individuals and your family. Compare top insurers for free health check-ups and tax benefits. Health Insurance Plans - Buy Health Insurance Online in India at an affordable price Here are some factors that can help you choose a good health insurance. Aditya Birla Health Insurance Logo Aditya Birla Activ Health Platinum Enhanced, Up to INR 2 Crores, Rs. /- Per month. View Plan ; ManipalCigna Health. Good Health Insurance TPA Ltd. (GHITL) is one of the earliest TPAs in India and was incorporated in The organization is run by thorough professionals from. Health insurance in India Health insurance in India is a growing segment of India's economy. The Indian healthcare system is one of the largest in the world. Compare Best mediclaim insurance ; (Dental/Ophthal coverage in a block of 3 years of continuous renewal, -, - ; OPD Medical Consultation (other than OPD. I recently did some research on the same and I feel that HDFC Ergo would stand out as the best insurance company for most people. Optima Secure. Choosing the best health insurance plan BEST Health Insurance in India in | Top 6 Health Insurance Plans in | Gurleen Kaur Tikku. List of Best Health Insurance Plans in India. Learn more about how to choose best health insurance policy and check the benefits to fulfil your medical. Best Health Insurance Plans · HDFC Ergo Optima Secure Health Insurance · Why Optima Secure is our top recommendation · Care Supreme Health Insurance · Why Care. You can choose from several types of health insurance plans, such as individual mediclaim policy, family floater plan, senior citizen plan, etc. Royal Sundaram General Insurance is a well-known insurance company in India, offering a variety of products such as health, auto, and travel insurance. It was. ManipalCigna ProHealth Insurance: This is a health insurance plan that is suitable for people who are single or recently married. The ManipalCigna ProHealth. Check the list of top 10 mediclaim policies available in India. Check features, plan details, premium details and all other important aspects online at. my:Optima Secure Global plans. Along with 4X health coverage, this plan provides a global cover which includes coverage for hospitalisation expenses within. Star Health Insurance Star Health and Allied Insurance Co Ltd is an Indian multinational health insurance company which provides services in health, personal. ICICI Lombard's iHealth Complete Health Insurance plan is one of the best health insurance plans in India that provides protection against any major medical. Buy/Renew health insurance plans in india, medical insurance policy with Niva Bupa that covers COVID, + Cashless Hospitals and Tax Benefits. 1. MAXIMUM HEALTH COVERAGE - Always prefer a plan that offers maximum health coverage and maximum amount for the treatment.

1 2 3 4 5